With great fanfare and lacking in any context or anything beyond linear thinking, The Hill recently published an article entitled “Trump Added Twice as Much to the National Debt as Biden.”

The article was based on a recent study by the Committee for a Responsible Budget that compared the fiscal records of the two presidents. The comparison was not based on what has actually been observable, but on the Congressional Budget Office’s own 10-year projections of spending.

Unfortunately, the CBO’s estimates take no account of the dynamic nature the candidates’ fiscal policies might have on the economy and often conflate the idea that allowing Americans to keep more of their own earnings is equivalent to government spending driven by the decisions of politicians and unelected bureaucrats to achieve policy goals that are often out of step with what a majority of the American public actually want.

Consumers of such studies should be suspect of the government’s projections of the costs of its own spending. Any empirical analysis of the CBO’s forecasts would show that they are often wildly inaccurate.

PRESIDENTIAL DEBATE: HOW MUCH DID THE DEBT GROW UNDER BIDEN AND TRUMP’S TERMS?

As an example, it originally scored President Biden’s much vaunted Inflation Reduction Act as reducing budget deficits by $238 billion over the next decade. Less than a year later, Goldman Sachs estimated that the IRA’s climate subsidies would cost the American taxpayer more than $800 billion than what was originally forecast, wiping out any savings to the taxpayer by a mere $1 trillion.

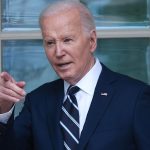

In terms of what has actually been observable thus far, it would be difficult to claim that there has been much difference on the impact on our national debt between the two candidates.

In the first three years of President Trump’s administration, America’s total debt increased by $2.5 trillion. In the first three years of Biden’s administration, our total debt increased by a staggering $4.7 trillion.

Even if one were to gloss over the fact that Biden’s term is not yet over, the worst that can be said is that America’s total debt burden increased by $6.7 trillion under Trump and $6.3 trillion under Biden over their four years.

HOW MUCH OF YOUR TAX MONEY GOES TOWARD SERVICING THE US NATIONAL DEBT?

The records are only remotely close due the spending incurred during the first year of the pandemic. Biden has no such excuse.

It is important to bear in mind that the CBO just increased their estimates for the budget deficit in the current fiscal year by $400 billion more than was forecast in February. This year’s forecast of a $2 trillion deficit is more than $300 billion greater than last year’s blowout deficit spending.

The proximate causes of this increase in spending by the Biden administration are not emergency related COVID spending, as they were in the Trump administration, but massive increases in student loan forgiveness, an expansion of the Affordable Care Act that covers illegal immigrants, bloated Medicare rolls that were never culled after the pandemic ended, and, of course soaring interest expenses.

Where all Americans should agree with the Committee for a Responsible Federal Budget is that our current fiscal trajectory is unsustainable. Never before has America run a budget deficit of 7% of GDP when the economy was not yet already in recession.

HOW THE US NATIONAL DEBT IS KEEPING MORTGAGE RATES ELEVATED

This is extremely dangerous because deficits will rise even further when the economy inevitably slows. So-called automatic stabilizers like unemployment insurance, welfare payments and food stamps surge during economic slowdowns.

America’s current twin deficits – its budget deficit and its trade deficit – mean that Uncle Sam is dependent upon the kindness of strangers (foreign governments) to fund its gargantuan spending needs. This weakens America’s sovereignty, poses a threat to its national security, and renders it more vulnerable to the whims of countries, like China, whose interests are often inimical to our own.

Without any attempt to rein in the spending trends established under Biden, an increase in the issuance of Treasury securities is likely to increase interest rates and potentially crowd out private investment.

What has made all of this worse is that Treasury Secretary Janet Yellen has decided to fund America’s long-term liabilities with ever-increasing amounts of short-term debt. The weighted average cost of all of America’s debt outstanding is only 3.2%, significantly lower than interest rates across the yield curve. This means that when our short-term debt rolls over, America’s interest expenses will soar.

Currently, our interest expenses are on the verge of surpassing our defense budget. Next year, America’s interest expenses will also exceed Medicare. This may serve crass political needs of the Democrats ahead of the election in November, but it puts America’s financial future at great risk.

The truth of the matter is that only commitment to the growth derived from the private sector can allow America to work its way out of its current debt situation. Biden has promised to let Trump’s 2017 Tax Cuts and Jobs Act expire at the end of 2025. This would lead to one of the greatest increases in taxes in the history of the United States. It would also inevitably increase the dependence of American citizens, particularly those at the lower end of income distribution, on the federal government.

President Reagan once quipped that Republicans tend to see every day as the Fourth of July, while Democrats see every day as April 15. Americans should remember that the “cost” of tax cuts is only felt by politicians and policymakers so intent on spending other people’s money. The costs of increased government spending are real and borne sooner or later by taxpayers themselves.

Only the Republicans and Donald Trump have promised to try to radically change permanent-Washington’s belief that the hard-earned income of its citizens is some sort of dispensation from government itself.

JASON DE SENA TRENNERT

Read the full article here