Our writers and editors used an in-house natural language generation platform to assist with portions of this article, allowing them to focus on adding information that is uniquely helpful. The article was reviewed, fact-checked and edited by our editorial staff prior to publication.

Key takeaways

- A normal part of the mortgage application process, conditional approval means the lender will give you a home loan, provided you address certain additional criteria.

- Common conditions to change approval from conditional to final include providing more financial or employment details, or addressing issues with the property title or appraisal.

- Even if you’re conditionally approved, you could be denied a mortgage — if you’re unable to satisfy the conditions set forth by the lender.

The road to getting a mortgage can be a long one, littered with multiple documents, endless waits and confusing updates. Case in point: You get a notice your loan is “conditionally approved.” Is that a yes or a no? In short, it’s a qualified yes — but you need to take certain steps to finalize your loan. Here’s how to navigate the conditional approval process and ensure a smooth path to homeownership.

What does conditionally approved mean?

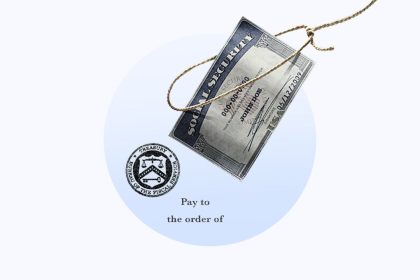

Applying for a loan to buy a house means meeting the standards and criteria set by a mortgage lender. That requires the fairly involved process of providing it with your financial documents (be ready to dig out pay stubs and tax returns). The lender’s underwriting team does this deep dive into your financial profile to make sure you can pay back the large sum you’re borrowing. They won’t approve you for financing until they’re confident you’ll be able to.

So, what does conditional approval mean? Sometimes, it’s just a standard stage in the process: If the lender needs more time during underwriting, it may alert the applicant that they’re conditionally approved. At other times, it may indicate a couple of hiccups in an application, requiring additional documents to address.

Generally, it means the lender will issue you the loan if (and only if) you meet the conditions it specifies. Some borrowers go straight from pre-approval to full approval, but in many cases, the lender may offer you conditional approval while it works with you to provide missing details, making it easier to move forward with your home purchase. Or you can request that designated status.

In either case, your status will be confirmed by a letter or statement indicating you have been conditionally approved.

Common causes of conditional approval

You could receive conditional approval if you have neglected these criteria:

- Getting a signed gift letter if someone is giving you money to help with the home purchase

- Providing enough detailed financials (e.g., bank statements, pay stubs, details on other debt like a car loan)

- Getting homeowners insurance

- Addressing a home appraisal that’s significantly below the purchase price/amount you’re borrowing

- Receiving confirmation from your employer that you’re on their payroll or receive wages from them

- Getting a letter from you explaining an issue that concerns the lender (e.g., a recent large withdrawal or fresh debt)

Why is conditional approval important?

When you get conditional approval, it means an underwriter has evaluated everything you’ve submitted and deemed you a good candidate for a mortgage — assuming you meet the stipulated conditions. Even if you’ve been conditionally approved, meaning there’s a strong likelihood of your loan going through, it’s not a guarantee until all conditions are met.

Conditional approval also often comes into play with home construction loans. If you are building a home or buying land to build a home on, the developer or general contractor might demand the financing be conditionally approved before they commit to the project.

Different types of mortgage approval

Conditional approvals are just one type of mortgage approval to be aware of. Here’s an overview of the others and how they differ:

- Prequalified: This status doesn’t hold much weight in terms of actual approval. Prequalified simply means the lender has gathered basic information from you and provided an estimate of how much you can potentially borrow for a home loan.

- Preapproved: Like a prequalification, a preapproval means you’ve submitted some information to the lender, and they’ve likely pulled your credit score. It states the maximum amount you can borrow, giving you a good idea of your home-shopping budget, one of the biggest questions you should get answered before you start house-hunting. But with preapproval, an underwriter hasn’t yet fully dug into your credit history details.

- Unconditional approval: Once you’ve satisfied all the lender’s criteria or conditions to get a home loan, you receive unconditional approval. It indicates the underwriter has signed off on your file and you’re one step closer to closing on the home loan.

- Verified approval: A verified approval indicates your assets, credit profile and income have also been substantiated and confirmed. It’s one of the last steps in the application process and provides assurance to the seller that you’re ready to move forward with the purchase.

What is the difference between conditional approval and preapproval?

Initial mortgage approval, often known as preapproval, is an early stage where the lender provides an estimate of what you may qualify for, based on a preliminary review of your income and credit data. This preapproval can give you the confidence to make an offer on a property, demonstrating to sellers that you’re serious about purchasing. However, a final loan decision requires a more in-depth verification of your details.

Conditional approval, on the other hand, comes in after initial approval — and in fact, after you’ve signed a contract to buy a home and formally applied for a mortgage. This stage involves a more comprehensive review of your financial situation by an underwriter, who then sets specific additional criteria that must be met for final approval.

Both stages are significant steps on your journey to owning a home, with conditional approval being a more advanced, promising phase.

If you’re refinancing, you might bypass initial approval and go straight to conditional approval.

Closing on a home after conditional approval

To close on your house, you need to finalize your loan. And that means moving from conditional approval to unconditional or full approval. To get there, you need to meet all of the conditions the lender has laid out.

In many cases, it simply means providing the lender with more information. That might involve reaching out to your employer or tax professional for additional documentation, drafting a gift or explanation letter or talking to an insurer to get the house covered.

Whatever the case may be, you won’t be able to get the mortgage — or close on the house — until you meet all the lender’s conditions. If you’re in a competitive market or the seller wants a quick closing, act fast here.

Checking off your conditions is just one piece of finalizing your home loan. You also need to be ready to pay closing costs. Your lender should explain everything required to get your loan in place.

What happens after a conditional approval is received?

Once you’ve received conditional approval for your mortgage, the journey toward final approval begins. The following steps are generally involved:

- First, address any issues that arise during the underwriting process promptly to move on to closing. This might involve completing or submitting supplementary paperwork, such as bank statements, tax forms, employment records, a home appraisal report or pay slips, and detailing remaining loan or credit balances.

- Once all the requirements are fulfilled, your loan file is returned to the underwriter for a final check and approval. Hopefully, the lender will grant you a ‘Clear to Close’ status, indicating all the documents have been approved and the lender is ready to move to the closing stage.

- The lender will then compile and send you a closing disclosure, and set up your closing date.

- The final step is the closing itself, when the loan funds are distributed, and you’ll get your first payment statement.

The journey from conditional approval to closing usually takes 1-2 weeks — provided you move promptly. Acting quickly is key to ensuring a smooth closing process.

FAQ on mortgage conditional approval

-

Yes. If the conditions aren’t met, your approval becomes null and void. For example, you could end up being denied because you didn’t get the requested documents in by the required date.

But conditional approval also allows the lender to back out of the deal if it sees anything it doesn’t like. For instance, if that last bank statement you send in shows a troubling pattern of spending — or uncovers a new type of debt you hadn’t disclosed — you could get denied.

However, a refusal isn’t necessarily permanent. You simply may need to restart the underwriting process, which means the size of your mortgage or its interest rate could change. Since you’ve already made it to conditional approval, though, the lender may be willing to work with you to reassess the loan.

-

For borrowers, factors such as acquiring new debts, a decrease in income or the underwriter’s inability to authenticate financial documents can derail the process. Also, an under-valued home appraisal, a claim against the property or unexpected issues discovered during a home inspection or title inspection can lead to a denial. In these sorts of situations, you, the buyer, need to resolve the problem with the seller. If there’s an appraisal gap, for example, maybe the sales price can be renegotiated.

-

To avoid a denial after receiving conditional approval, it’s crucial to closely manage your finances, steer clear of new debts and provide all necessary information in a timely manner. This includes promptly addressing any issues that crop up during the underwriting process and completing any extra paperwork as required.

It’s also vital to communicate clearly and consistently with your lender throughout the process and to promptly inform it of any major changes in your financial circumstances.

Read the full article here