A little-known digital asset trading firm is seeking to navigate the vast and murky waters of U.S. crypto regulation with the appointment of a legal veteran as its new compliance chief, FOX Business has learned.

Flowdesk, a four-year-old French startup and liquidity provider for some of Wall Street’s crypto ETFs, has added seasoned securities lawyer James Morgan to its C-suite, in a move to position the firm as a major institutional player in the U.S. crypto market.

“The U.S. is a strategically important market,” Flowdesk CEO Guilhem Chaumont told FOX Business. “Developing a solid regulatory approach is a major piece of the puzzle. Adding someone of James’ caliber, with his nearly 10 years of regulatory crypto experience, Flowdesk will be well prepared to succeed and grow its business in the U.S.”

DONALD TRUMP AND JD VANCE CREATE A PRO-CRYPTO PRESIDENTIAL TICKET

Since opening its U.S. office a year ago, Flowdesk has flown largely under the radar. However, it briefly made headlines in January for a successful Series B funding round that included backers like crypto payments company Ripple. That same month, Flowdesk quietly agreed to act as a liquidity provider for crypto asset manager Grayscale when it launched one of the 11 spot bitcoin ETFs alongside Wall Street titans BlackRock and Fidelity. It’s doing the same thing for Grayscale’s ethereum ETF, which began trading on Tuesday.

The appointment of Morgan, whose 20-year legal career spans both crypto and traditional finance, comes as the U.S. crypto industry could be on the brink of a new regulatory frontier with the upcoming presidential election.

It also follows a trend of crypto firms adding “TradFi” (traditional finance) veterans to their executive ranks, as the still-nascent industry pursues mainstream adoption and legitimacy. Flowdesk appointed TradFi-turned-crypto veteran Reed Werbitt as its U.S. CEO in September.

Attorneys like Morgan who bring niche expertise in both digital and traditional securities law, are in high demand as U.S. regulators like the Securities and Exchange Commission are trying to bring crypto under its purview.

RIPPLE LEADS POLITICAL PUSH WITH SECOND $25M DONATION TO CRYPTO SUPER PAC

“I’m excited to be joining the team at Flowdesk at such a pivotal time for crypto,” Morgan told FOX Business in an exclusive interview. “How this next administration approaches regulation will set the tone for years to come.”

Over the last three years, President Biden’s SEC chief Gary Gensler has waged a sweeping regulatory crackdown on the $2 trillion crypto industry, bringing enforcement actions against some of its biggest players. Gensler has said the crypto industry is rife with bad actors who are violating securities laws by refusing to come in and register with the commission. The crypto industry says it’s not that simple and the existing registration process doesn’t align with the nuances of blockchain technology, resulting in a regulatory impasse.

Meanwhile, Republican presidential nominee Donald Trump has been wooing the industry in the run-up to the November election with promises to loosen regulations for the crypto industry and put an end to what he’s dubbed “Biden’s war on crypto.”

Morgan is no stranger to dealing with financial regulators from both political parties. He brings 10 years’ experience in compliance roles at the New York Stock Exchange – the world’s largest equities exchange, and the Miami Stock Exchange (actually based in New Jersey), where he regularly dealt with the SEC, the Commodity Futures Trading Commission and the Financial Industry Regulatory Authority.

His more recent roles as general counsel at digital asset trading firms FalconX and Genesis Global Trading have allowed him a front-row seat to regulators’ evolving positions on digital assets.

CLICK HERE TO SEE LIVE CRYPTOCURRENCY PRICES

“The regulatory landscape in the U.S. has been evolving steadily through the years,” Morgan said. “At times, this evolution has occurred slowly, but I think there is strong potential in the near future that the pace of regulatory change will speed up rapidly and Flowdesk will be prepared for this possibility.”

It’s no secret that crypto regulation has become a political football this year. Republican lawmakers, who have generally been more receptive to digital assets than their Democrat colleagues, have been pushing for legislation that would help give crypto the regulatory clarity it’s been looking for.

Democrats realize they’re now playing catch-up as Trump and his running mate JD Vance have appealed to a large swath of the pro-crypto crowd, many who identify as single-issue voters, meaning they’ll vote for the candidate that’s most friendly toward crypto regardless of other political views.

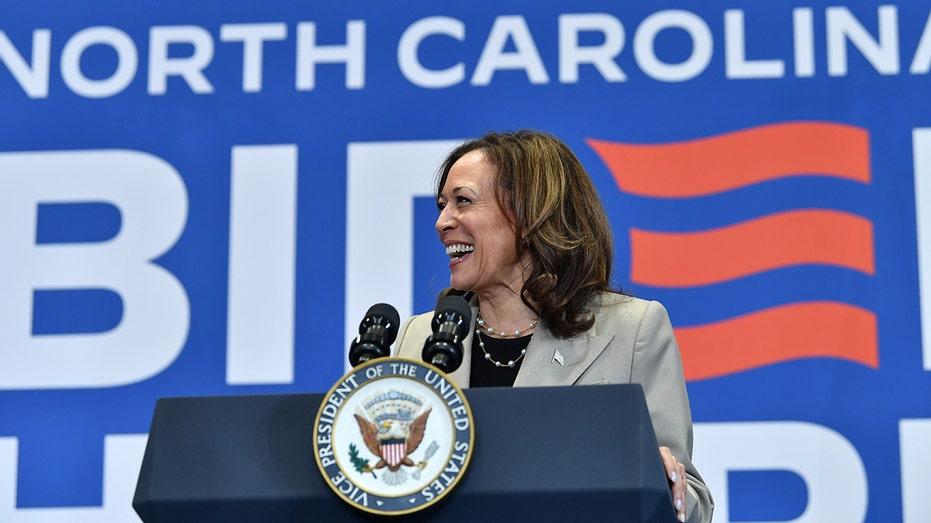

In the wake of Biden’s announcement on Sunday that he will not seek re-election, the political impact on the crypto industry is more uncertain than ever. Vice President Kamala Harris, who will likely become the presumptive Democratic nominee, has not signaled a clear position on crypto, and it’s unknown if Gensler will remain SEC chair if she’s elected.

A Trump victory and a Republican sweep of Congress could usher in a new era of growth for crypto innovation in the nation, by which companies like Flowdesk and others looking to expand in the U.S. would stand to benefit.

Read the full article here