Skip the searching and find the top financial products of 2024, all in one spot. From insurance companies to investment accounts, we’ve got you covered.

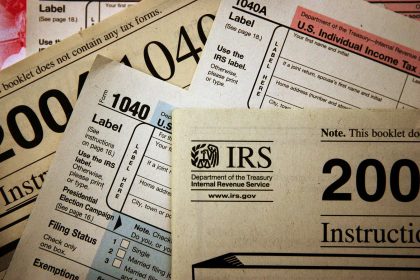

Taxes

IRS Apologizes To Ken Griffin And Other Billionaires For Tax Leak

Kenneth C. Griffin, the billionaire plaintiff seeking damages in the Littlejohn leaker suit, has reached…

Kamala Harris’ 28% Capital Gains Tax Plan Is A Surprise. Here’s Why

Vice President Kamala Harris has proposed a 28% tax on long-term capital gains for Americans…

An Overview Of Common IRS Penalty Defenses For A Late-Filed Form 3520

Corrected, July 18, 2024: This article has been updated to fix a typo in the…

Grounded By IRS: U.S. Passport Denied Or Revoked For Delinquent Taxes

Did you know that your U.S. passport could be denied, revoked, or not renewed if…

Despite Ruling, Fights Over Maryland’s Digital Advertising Tax Continue In Court

Maryland’s digital advertising tax—codified as the Digital Advertising Gross Revenue Tax Act—is in the news…

What to Know About Form 8889 for HSAs

If you’ve made contributions to or taken distributions from a health savings account (HSA), the…

Modeling A 1% Wealth Tax—Back Of The Envelope Calculations

A wealth tax is a levy imposed on the net value of held assets, including…

Navigating New IRS Form 1099 Rules And Understanding Reasonable Cause

Corrected, July 19, 2024: This article has been updated to fix a typo in the…

IRS Finalizes Guidance On Treatment Of Inherited IRAs

The IRS has issued more guidance on the required minimum distribution (RMD) rules—this time in…

California Raises Taxes Again By Restricting Net Operating Loss Use

Taxes are annual, but if you are in business, you can generally rely on using…

New FAQs And Legal Updates Impact Embattled New Company Reporting Law

As of January 1, 2024, many companies were required to report information to the U.S.…

What Is the 2024 Federal Solar Tax Credit?

The Federal Solar Tax Credit, also known as the Investment Tax Credit (ITC), provides an…