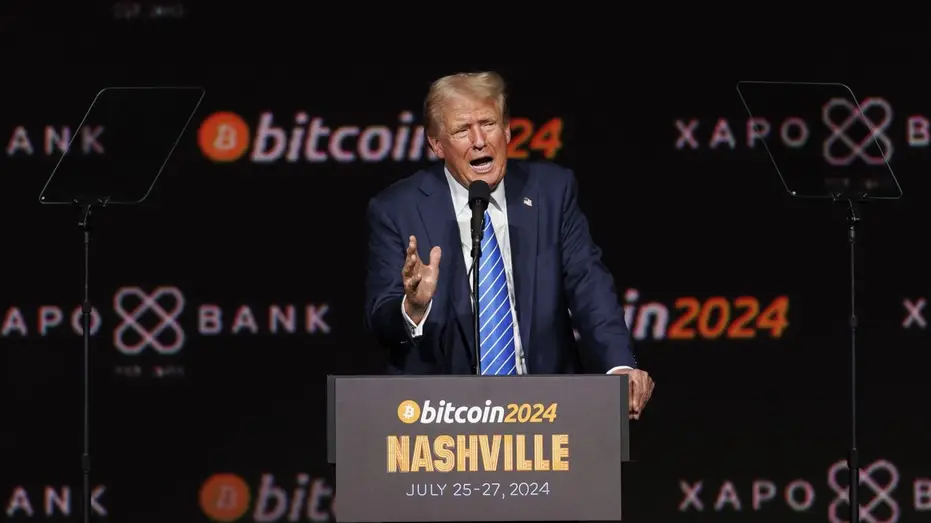

Republican SEC Commissioner Mark Uyeda wants to help president-elect Donald Trump fulfill his promise of ending the Biden Administration’s so-called war on crypto, FOX Business has learned.

Uyeda, who has served on the commission since 2022 and would likely become acting chair when Trump takes the reins in January, tells FOX Business that one path forward for the agency under Trump would be to pause new enforcement actions against firms that have failed to register until there are some clear rules of the road in place.

“The Commission’s war on crypto must end, including crypto enforcement actions solely based on a failure to register with no allegation of fraud or harm,” he said. “President Trump and the American electorate have sent a clear message. Starting in 2025, the SEC’s role is to carry out that mandate.”

Uyeda’s statement echoes Trump’s campaign promise of ending the Biden Administration’s war on crypto under current SEC Chair Gary Gensler, who has brought more than one hundred enforcement actions against the industry over the last three years. Many of those cases involved legitimate wrongdoing, including instances of fraud and money laundering, like that against Sam Bankman-Fried, the now-jailed founder of bankrupt exchange FTX.

But others involve more prosaic rule violations, like the high-profile lawsuits against Coinbase, Ripple, Kraken, Consensys and Cumberland DRW, which were filed due to Gensler’s belief that the firms were engaging in the sales of unregistered securities.

It’s unclear what a pause on all new enforcement actions over failure to register with the commission would mean for companies that are in active litigation on this matter, like Coinbase and Ripple. However, such a mandate from the commission could encourage judges to take the agency’s new position into consideration in their courtrooms.

Gensler’s position—that all crypto tokens aside from bitcoin and ether are securities under the SEC’s jurisdiction—has faced strong opposition from the crypto industry, its legal advocates and numerous members of Congress. It’s also drawn heavy criticism from fellow commissioners like Uyeda and Hester Peirce, who have advocated for a more transparent approach to regulation, including creating clear guidelines for digital assets and working directly with industry participants.

While Trump has vowed to “fire” Gensler on his first day in office, he only has the power to take away his chairmanship. If he wanted to, Gensler could stay on as a commissioner until his term expires in June 2026, and some have speculated that he may choose to do so as a way of hindering Trump’s policy decisions. Trump will likely promote Uyeda to lead the agency, at least until he names a new chair.

The SEC did not immediately respond to a request for comment.

Peirce’s term finishes in June 2025 and sources tell FOX Business she has expressed privately that she does not want to be chair. Instead, these sources say, she’s interested in leading an internal “crypto task force” that would, in part, re-evaluate the agency’s approach to crypto and create an open dialogue with industry.

Peirce, who has earned the name “Crypto Mom” for her favorable views of the industry, has been a proponent of so-called “safe harbors” which allow companies working with new and emerging technology, like blockchain and AI, the ability to operate under the observation of the agency but without the threat of enforcement actions.

A staffer for Peirce declined to comment.

Uyeda has also been a vocal critic of how the agency has approached digital asset regulation. Last month, he made headlines following an appearance on FOX Business where he described the agency’s policies and approach to crypto as a “disaster for the whole industry.”

“We have been sending this ‘policy through enforcement,’ we’ve done nothing to provide guidance on it,” he said.

Read the full article here